The End of the Long Twentieth Century? The Rise of China and the Possibilities of a New Global Fordism

archive

The End of the Long Twentieth Century? The Rise of China and the Possibilities of a New Global Fordism

It is now 20 years since the publication of Giovanni Arrighi’s The Long Twentieth Century, a highly influential and ambitious work charting the evolution of global capitalism over five centuries. Arrighi’s account posits the history of capitalism as a series of secular cycles, each consisting of expansionary material and financial phases. Every cycle is led by a hegemonic state, which houses an alliance of capitalist and governmental agencies best placed among various competitors to create the conditions for a stable profitable investment regime. The incipient hegemon’s competitive advantages over rivals (organizational, technological, geographical, etc.) gradually allow its capitalists to become the central actors in and beneficiaries of the most profitable circuits of accumulation. The dynamism of the hegemonic state-capital alliance drives (uneven) growth across the world-system as a whole, meaning that, generally speaking, the interests of all other capitalist actors become increasingly tied to supporting continued processes of hegemonic expansion. This tends to establish periods of relatively stable systemic growth, the material phase, which are eventually progressively undermined by their own contradictions. As returns on productive expansion under the organizational paradigm instituted by the hegemon diminish, capital begins to pull out of these activities and retreat into finance, in search of higher returns. The ensuing phase of financial expansion constitutes a brief belle époque in which the power of the hegemon appears to be resurgent. This proves illusory, however, as the financial expansion, not underpinned by growth in the real economy but in fact predicated upon an undermining of the bases of real growth, tends towards instability and quickly generates crisis. In turn, declining returns to financial capital promote a search for investment opportunities in a rising state-capitalist bloc that possesses the most advantages under the new conjuncture, eventually emerging as the new hegemon and providing the basis for another round of material expansion.

The dynamism of the hegemonic state-capital alliance drives (uneven) growth across the world-system as a whole, meaning that, generally speaking, the interests of all other capitalist actors become increasingly tied to supporting continued processes of hegemonic expansion.

In this way, American hegemony in the early 20th century emerged as a result of positional advantages over rivals such as the UK (the declining hegemon) and Germany. Containing abundant natural resources and isolated from wars in Europe, the US was also home to important organizational revolutions in production and management of capitalist enterprises during this period. By the end of World War II, American hegemony had been cemented and formed the centerpiece of a global Keynesian-developmentalist regime1 that sustained several decades of stable capitalist expansion. By the 1970s, though, with rising competition from Japan and West Germany, combined with an exhaustion of productivity gains from the Fordist template, the material phase of the US-led cycle began to unravel, prompting a replacement by financialization (and associated neoliberalism) which came to dominate the US and global economy in subsequent years.

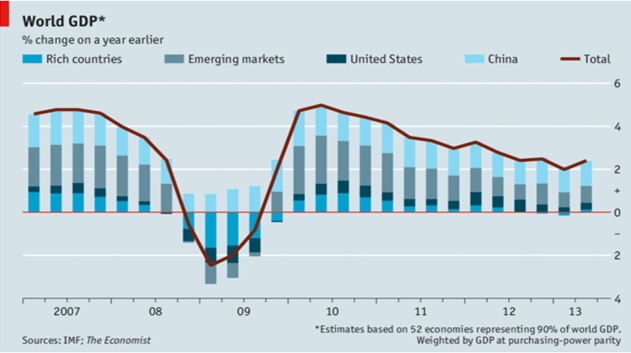

Given the financial crisis of 2008 and the relatively sluggish performance of the US economy since, could China now be emerging as the new center of global accumulation? The graph below gives some indication that this could be the case. As can be seen, Chinese demand, propped up by a massive public investment program, was instrumental in helping the global economy through the aftermath of the crisis. Even in more recent years, however, China has been the single largest contributor to world growth. In 2013, for example, China accounted for half of all global economic expansion, while the entire developed world’s contribution amounted to only one fifth of the total.

These figures alone do not of course demonstrate that global Chinese hegemony is imminent. Whether China can form a new center for global accumulation in the long run depends crucially upon the Chinese state-capitalist alliance’s ability to surmount obvious barriers to a path of stable expansion at home and abroad. These are linked to the decline of the current accumulation cycle, most obviously seen in the lack of growth in Northern markets post-2008.2 Since the Chinese economic miracle was founded principally upon the production of cheap exports to these markets, their collapse seems to imply a looming impasse for the Chinese economy. The impact of the loss of export markets has been countered by a huge stimulus package, but this reliance on debt-led investment as a source of growth seems unsustainable in the longer term. If Northern markets continue to stagnate, growth in developing world consumption3 may offer an alternative opportunity for continuing Chinese development.

Though innovation is often associated with advanced technology, China’s major innovative advantage over its rivals may lie in its firms’ superior ability to produce cheap and appropriate products for the emerging markets of the global South. A study by McKinsey (Atsmon et. al. 2012) estimates that from 2010 to 2025 the size of the global consuming classes—that is, those individuals with a daily income of $10 per day or more—will grow by two billion. Of the projected $26 trillion increase in annual consumption over that period, 70% of the growth will come from the global South. These new consumers will have very different requirements than the middle classes of the North. Most of these individuals will be entering new consumer goods market sectors for the first time, purchasing a first refrigerator or perhaps a first car. With highly constrained incomes, the simple fact of owning such goods—at the cheapest price possible—will be of far greater priority than the differentiation based on branding or quality which is paramount in ‘mature’ markets where producers of the global North retain an edge over their PRC counterparts. Chinese producers do, however, possess the capabilities to produce a wide range of consumer (and capital) goods cheaply and efficiently, and are furthermore likely to have a better idea of the needs of developing world consumers than their competitors in the North.

In turn, growing consumption of these goods by emerging consumers and producers may allow for new opportunities within their own economies. Kaplinsky (2013) gives the example of Chinese-built motorcycles in Cameroon (right). Though less reliable than the Japanese alternative, they sell at one third of the cost, which has facilitated their purchase by youths who have used them to become taxi drivers and couriers, known as “okada riders.”

Chinese expansion built upon this emerging consumption has the potential to develop into a kind of new global Fordism. The Zotye TT, China’s cheapest car, is unappealing to most rich world consumers in terms of brand image, features, or safety. Yet the Zotye TT and its counterparts4 are nevertheless bringing car ownership within reach of a new tranche of the global population, meeting growing demand which is not effectively addressed by existing forms of capitalist production. Fordism, symbolized by the Model T, sparked decades of expansion by marrying mass consumption among the American and European working classes to new forms of mass production. In the coming decades, a further widening and deepening of the capitalist world-system towards mass consumption on the part of billions in the global South may well present the most promising route for the re-establishment of conditions needed for stable global accumulation, representing what Arrighi might see as a new cycle in the evolution of global capitalism.

1 In broad brush strokes this meant Keynesian demand management and Fordist mass consumption in the global North, with state-capitalist industrialization drives in the South.

2 The United States has performed somewhat better than Europe or Japan in this regard, helped by low energy prices from the roll-out of fracking processes for the extraction of natural gas. The US has not, however, reverted to average GDP growth levels seen in the 1970s and 1980s and certainly has not approached those seen in the 1950s-70s.

3 Fueled, in part, by Chinese demand for commodities from many of these states.

4 Which also include offerings from other Southern manufacturers such as the Indian Tata Nano.

Arrighi, G. (1994). The Long Twentieth Century: Money, power, and the origins of our times. Verso.

Atsmon, Y., Child, P., Dobbs, R., Narasimhan, L. (2012, August). “Winning the $30 trillion decathalon: Going for gold in emerging markets”. McKinsey Quarterly. Retrieved from http://www.mckinsey.com/insights/strategy/winning_the_30_trillion_decathlon_going_for_gold_in_emerging_markets

Economist. (March 22, 2014). “World GDP”. Retrieved from http://www.economist.com/news/economic-and-financial-indicators/21599367-world-gdp

Kaplinsky, R. (2013). “What contribution can China make to inclusive growth in sub‐Saharan Africa?” Development and Change, 44(6), 1295-1316.