Mineral Resources: A Financial Trap for Developing Economies?

archive

Mineral Resources: A Financial Trap for Developing Economies?

The discovery of valuable mineral resources can be the answer to manifold economic difficulties and effective management of their extraction can catalyze development. Infrastructure—a railway through the Andes, for instance—is often the beneficiary of the extractive sector’s sudden growth; similar development has been seen in Asia as well. This was a common occurrence in the 1970s, when resource prices were very high. The use of resources as collateral for loans has expanded not only in emerging economies, but also in already developed countries. As resources are increasingly used in the production of different goods, their demand rises. For example, in China, resources are used extensively in their ever-growing manufacturing and infrastructure development projects which in turn has fueled demand from resource-producing countries around the world, particularly since the 1960s. According to the World Bank, merchandise exports as a percentage of GDP have surged to record highs, close to 70% in Chile, around 120% in Mexico, and 200% in Malaysia, all since 2000.

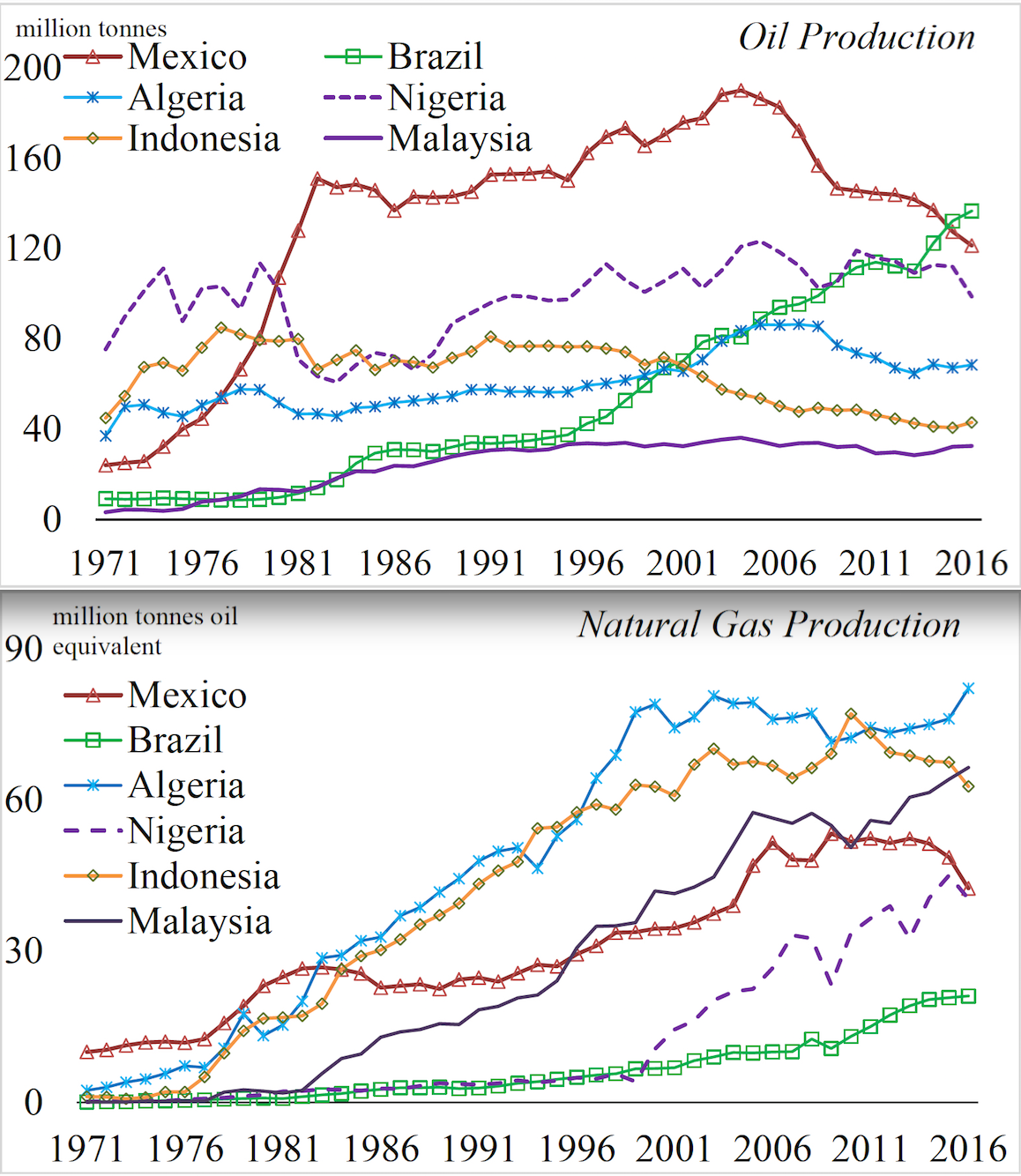

Thus extractive industries, e.g., copper, gold, oil, and natural gas, have grown rapidly in many developing countries. Historical data on energy production points to especially dramatic increases, as shown in Figure 1. This massive production highlights the importance of the non-renewable resource sector to the economic growth of developing resource-rich countries. By facilitating extraction and production processes, advances in technology have played a role as well, providing better access to deposits and faster and cheaper transportation. A well-managed mining sector can promote employment, provide investment opportunities, finance infrastructure, education, health care, and meet other social needs. Therefore, mining companies have become major drivers in economies where resources are used to finance development. But there are also downsides and risks associated with this development model, as we recently witnessed following the collapse of oil prices after 2014.

Figure 1. Energy Production. Source: Constructed using data from the BP Statistical Review of World Energy 2017.

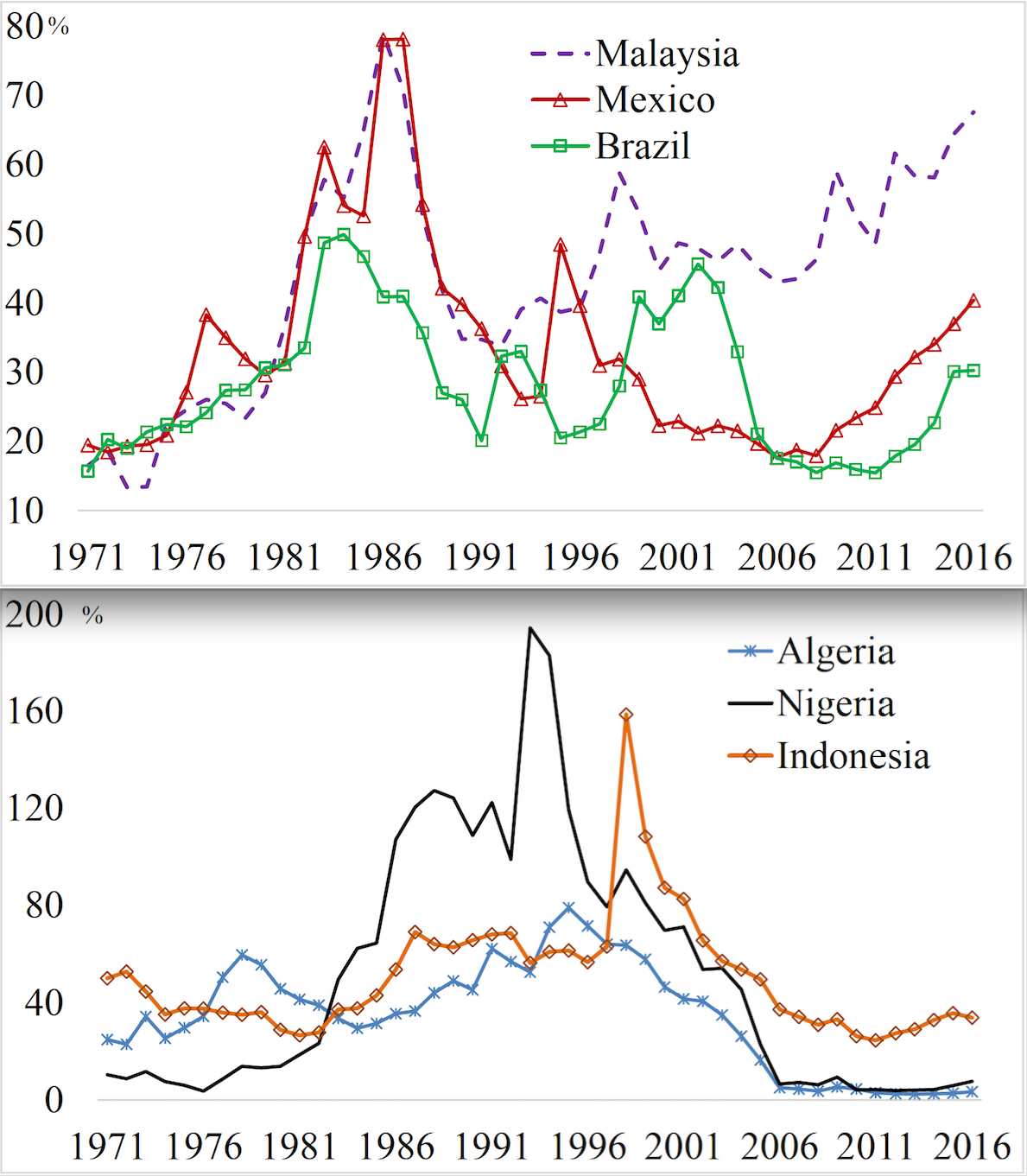

The distinction between resource-rich and resource-poor countries is based on the possibility of earning additional revenues from exporting mineral resources. Different measurements are used in various IMF working papers; these define whether a country is resource-rich or not. Countries are classified as resource-rich if the share of resource revenue in total fiscal revenue or the share of resource exports in total exports is at least 20% (see IMF 2012, p. 48). In African countries, resources contribute almost 90% of total fiscal revenue, whereas in other countries such as Venezuela the share stands at 60% and in Kazakhstan at 40%. According to the World Bank, in both Algeria and Nigeria, shares of fuel exports to overall exports rose from around 60% in 1970 to almost 100% in the late 1970s, and have remained at this level ever since.

Similarly, Chile’s exports largely depend on copper and other ores, with the share of ores and metals in total exports standing at around 90% in 1970, but falling to around 60% in 2016. Due to resource exhaustibility, diversification into the non-resource sector is crucial. Some countries have already shown progress towards this goal. For example, the share of fuel exports in Malaysia’s total exports, which stood at around 40% in the mid-1980s, dropped to less than 20% in recent years.

The contributions of the mining and metal sectors to an economy can be gleaned from the Mining Contribution Index (MCI), as provided by the International Council on Mining & Metals (ICMM). Major components of the MCI include mineral exports, mining production value’s share of GDP, and mineral rent’s share in GDP. The top ten countries listed in the 2016 MCI ranking are the Democratic Republic of Congo, Mauritania, Burkina Faso, Madagascar, Botswana, Guyana, Uzbekistan, Liberia, the Kyrgyz Republic, and Tajikistan (see ICMM for details). According to the MCI, minerals and metals played an important role even during periods of low resource prices.

mining companies have become major drivers in economies where resources are used to finance development. But there are also downsides and risks associated with this development model...

However, as resource-rich countries globalize, their dependence on external demand and financing increases. This can make the domestic economy more vulnerable to outside shocks. Some of the underlying factors include resource price fluctuations, a slowdown in the economic growth of a major trading partner, increased trade barriers, debt and financial crises, and geo-political conflicts. These relationships are discussed in a number of research papers.1 One of the issues concerns debt that may be used for the import of capital goods to increase domestic production, to search for more resources, and/or support industrialization. However, for a positive impact to result, the debt must be carefully managed.

During the 1970s, when resource prices were high, resource-rich countries borrowed extensively from the international capital market using their resources as collateral. Historical data on external debt stock and its share in GDP are illustrated in Figure 2 for different resource exporting countries. Resource prices fluctuate and affect export revenues; thus, through continued financing of domestic consumption and/or repayment of debt, external debt increases. A number of countries were hit by the debt crisis during the 1980s, especially Latin American countries. Some defaulted on their debt. In recent years, external debt burdens have increased in several developing countries including Kazakhstan, Malaysia, and South Africa. The breakdown of the debt statistics reveals whether short-run or long-run debt dominates. An increase in short-run external borrowing in certain countries, especially in East Asia, heightens liquidity risk and currency risk, and makes these countries more vulnerable to external shocks.

Figure 2. External Debt Stock’s Share in GDP. Source: Constructed using data from the World Bank’s World Development Indicators.

In many developing countries, resource companies are owned by the state. According to UNCTAD (2017), state-owned multinational enterprises are concentrated in the resource sector and they have been gradually internationalized through an increase in foreign direct investments. Foreign assets as a share of the total assets of mining, quarrying, and petroleum firms average around 4-6%, which is significantly lower than in other industries. Major state-owned mining companies in developing countries have massive total assets: China National Petroleum Corp, Russia’s Gazprom JSC, Petroleo Brasileiro SA, Petróleos de Venezuela SA, Malaysia’s Petronas - Petroliam Nasional Bhd, Algeria’s Sonatrach. In order to finance the extractive business and subsequent production, state-owned companies borrow from international capital markets.

Their resources are used as collateral; because of perceived risk, a high interest rate is often demanded, which thus constrains their access to funding. Borrowing costs for such companies increased significantly, especially in recent years when they were hit by plummeting resource prices. Faced with a massive loss of revenue, liquidity problems, and difficulty covering operational costs, in particular cases, projects had to be canceled or postponed, resulting in layoffs. Some companies, e.g., Mexico’s state-owned Pemex, needed government support. Challenges such as these undermine macroeconomic stability, as the fiscal budget, as well as the current account deteriorates, and foreign debt burdens increase.

Thus, it is important to study the impact of extraction rates for non-renewable resources and external debt accumulation on the sustainability of economic growth and the welfare of society. In particular, one should consider different environments, reflecting resource booms (high resource prices) and resource busts (low resource prices) (see, e.g., Nyambuu and Semmler 2017a). Statistical analysis can demonstrate how over-borrowing affects dynamic patterns in development and consumption over time, revealing nonlinear effects. Results depend on the degree of leveraging as well as purpose of the borrowing. While some countries have used the borrowed funds for productive long-term investments, others, including Venezuela, used them to service debt and/or finance social spending (see Nyambuu 2016). We want to highlight the importance of productive investments, as they satisfy development goals and provide an opportunity to save for future generations. Future consumption is thus promoted, as opposed to enlarging current consumption, which often leads to increased debt. Simulation results appear to be consistent with the observed fact that energy exporters are experiencing excessive debt burdens, and increased default risk and borrowing costs.

1. E.g., Rodrik (1997), Easterly et al. (2001), Di Giovanni and Levchenko (2008), Nyambuu and Bernard (2015), Nyambuu (2016, 2017), Nyambuu and Semmler (2014, 2017a, 2017b), and Nyambuu and Tapiero (2018).

BP Statistical Review of World Energy. 2017. Accessed on November 21, 2017. https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html.

Di Giovanni, J., & Levchenko, A. (2008). Trade Openness and Volatility. IMF Working Paper, WP/08/146. http://www.imf.org/external/pubs/ft/wp/2008/wp08146.pdf.

Easterly, W., Islam, R., & Stiglitz, J. E. (2001). “Shaken and stirred: Explaining growth volatility.” In B. Pleskovic & N. Stern (Eds.), Annual World Bank Conference on Development Economics.

International Council on Mining & Metals (ICMM). Role of mining in national economies (3rd ed.). Retrieved from https://www.icmm.com/website/publications/pdfs/society-and-the-economy/161026_icmm_romine_3rd-edition.pdf

International Monetary Fund. IMF. (2012). Macroeconomic policy frameworks for resource-rich developing countries. Retrieved from https://www.imf.org/external/np/pp/eng/2012/082412.pdf

Nyambuu, U. (2016). “Foreign exchange volatility and its implications for macroeconomic stability: An empirical study of developing economies.” In L. Bernard & U. Nyambuu (Eds.), Dynamic modeling, empirical macroeconomics, and finance: Essays in honor of Willi Semmler (pp. 163-182). Switzerland: Springer International Publishing.

Nyambuu, U. (2017). “Financing sustainable growth through energy exports and implications for human capital investment.“ In Inequality and Finance in Macrodynamics, B. Bökemeier and A. Greiner (eds). Dynamic Modeling and Econometrics in Economics and Finance, Volume 23. Switzerland: Springer International Publishing.

Nyambuu, U., & Bernard, L. (2015). “A quantitative approach to assessing sovereign default risk in resource-rich emerging economies.” International Journal of Finance and Economics, Wiley 1512. doi:10.1002/ijfe.1512.

Nyambuu, U., & Semmler, W. (2014). “Trends in the extraction of non-renewable resources: The case of fossil energy.” Economic Modelling, 37(C), pp. 271–279. doi:10.1016/j.econmod.2013.11.020.

Nyambuu, U., & Semmler, W. (2017a). “Emerging markets’ resource booms and busts, borrowing risk and regime change.” Structural Change and Economic Dynamics, 41, 29–42.

Nyambuu, U., & Semmler, W. (2017b). “The challenges in the transition from fossil fuel to renewable energy.” In: T. Devezas, J. Leitão, & A. Sarygulov (Eds.), Industry 4.0 entrepreneurship and structural change in the new digital landscape (pp. 157–182). Springer International Publishing.

Nyambuu, U., & Tapiero, C. S. (2018). Globalization, Gating, and Risk Finance. England: Wiley.

Rodrik, D. (1997). Has globalization gone too far? Washington, DC: Institute for International Economics.

The World Bank. Development Indicators Databank. Retrieved from http://databank.worldbank.org

UNCTAD. (2017). World investment report 2017. Retrieved from http://unctad.org/en/PublicationsLibrary/wir2017_en.pdf